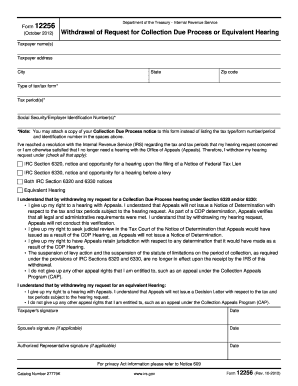

IRS 12256 2020-2026 free printable template

Instructions and Help about IRS 12256

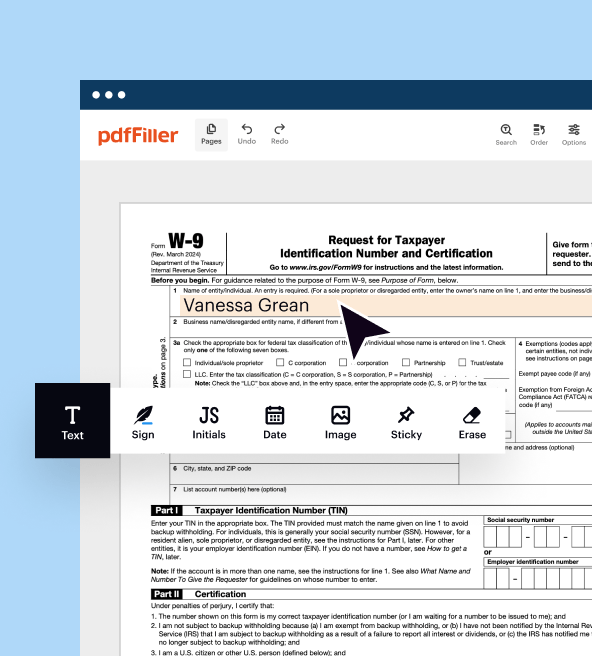

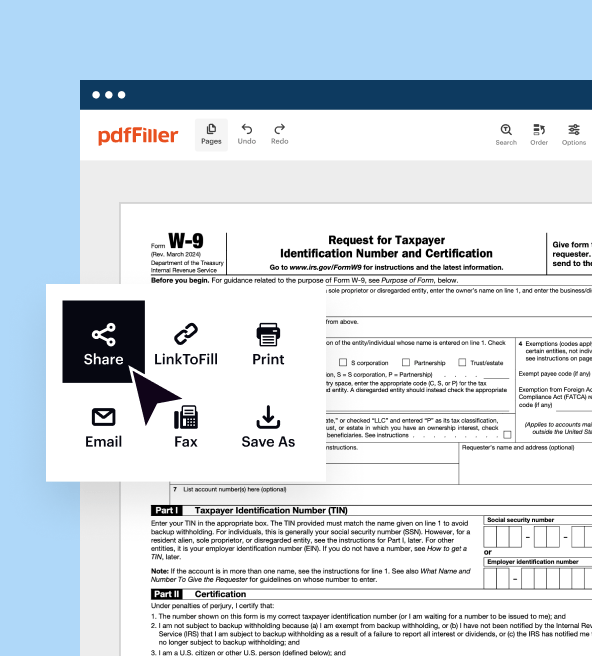

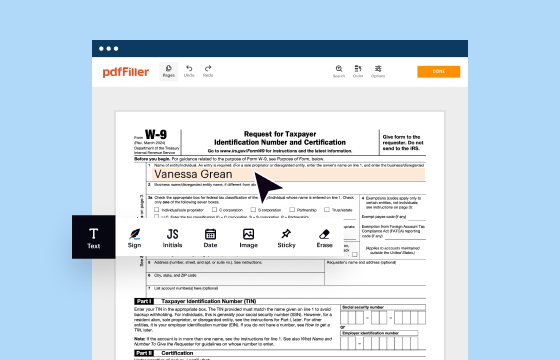

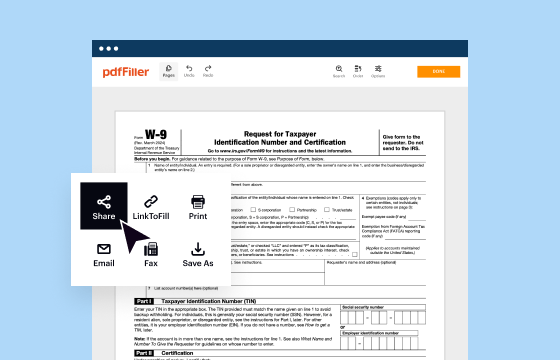

How to edit IRS 12256

How to fill out IRS 12256

Latest updates to IRS 12256

All You Need to Know About IRS 12256

What is IRS 12256?

Who needs the form?

Components of the form

What payments and purchases are reported?

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 12256

What should I do if I realize I made an error on my IRS 12256 after submission?

If you discover a mistake on your IRS 12256 after filing, you will need to submit a corrected form. Use the appropriate procedures for amending your form to ensure compliance and accuracy.

How can I track the status of my IRS 12256 submission?

To verify the status of your IRS 12256 submission, visit the IRS website or use designated tracking tools. This allows you to monitor receipt and processing, with clarity on any potential issues.

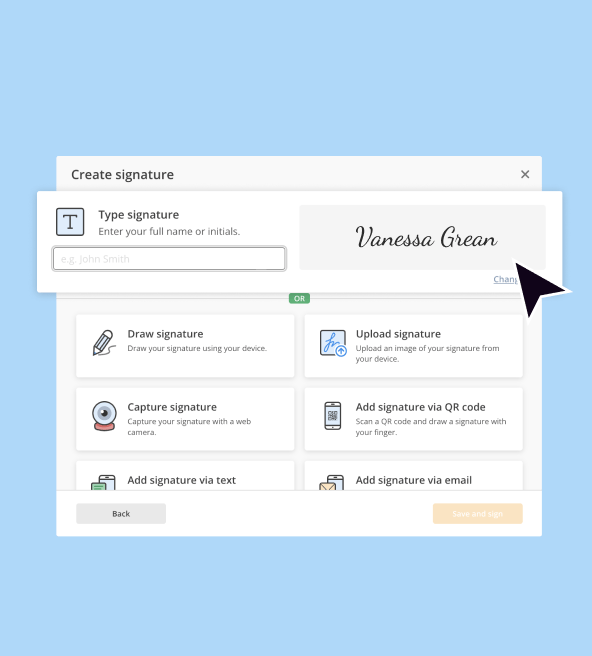

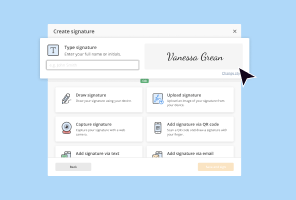

Are electronic signatures acceptable for the IRS 12256?

Yes, electronic signatures are generally acceptable for the IRS 12256, provided that you adhere to IRS guidelines. Always confirm the specific requirements, as they may vary depending on the context of your filing.

What can I do if I face common e-file rejection codes for IRS 12256?

If your IRS 12256 is rejected due to common e-file rejection codes, review the feedback provided. Address the specific issues outlined, and resubmit your form to ensure successful processing.

What should nonresidents/foreign payees consider when filing IRS 12256?

Nonresidents or foreign payees filing IRS 12256 may face unique requirements. It's essential to consult IRS guidelines or a tax professional to ensure compliance with specific regulations pertinent to your status.